Materially Neglected: Agricultural Methane and Investor Risk

Methane is responsible for roughly 0.5°C of current global warming. It’s over 80 times more potent than CO₂ over 20 years, but it only lasts about a decade, making reducing methane the fastest way to slow near-term warming. Even if fossil fuel emissions stopped tomorrow, agricultural methane alone could push the world past the 1.5°C warming limit. Cutting methane this decade is essential to prevent dangerous overshoot.

Agriculture is the largest source of human-caused methane, responsible for around 42% of emissions. Livestock accounts for the majority (32% of total methane emissions), followed by rice cultivation (9%). This agricultural methane has driven roughly 30% of the global temperature rise since the industrial revolution.

This report, Materially Neglected: Agricultural Methane and Investor Risk, follows two earlier analyses. The 2023 Hot Money report, by Changing Markets Foundation and Planet Tracker, was the first to quantify methane emissions across 15 leading meat and dairy companies and identify 40 investors funding them. Planet Tracker’s 2025 Methane Matters report estimated methane emissions across 52 meat, dairy and rice companies. This new analysis focuses on accountability, examining whether investors now treat agricultural methane as a material climate and financial risk, and whether their strategies reflect this.

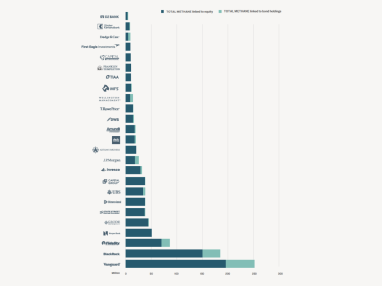

Figure 1 shows the total agricultural methane emissions linked to the holdings of major global investors. A small number of investors, including Vanguard, Blackrock and Fidelity Investments, account for a disproportionate share of financed methane emissions through the meat, dairy and rice companies in which they are invested.

Figure 1: Methane footprint of the top 25 investors’ equity and bond holdings (tonnes of CH4).

Despite this exposure, our analysis found that investor action is limited. Drawing on publicly available disclosures, we assessed investor practice across two key areas:

- Integration of methane into investment and risk frameworks,

- Engagement with high-methane sectors.

Our assessment shows that methane is almost entirely absent from investment and risk strategies. Only four investors (out of 25 analysed) explicitly acknowledge methane’s short-term warming impacts and mitigation potential. Most treat methane as a secondary component of CO2 equivalent frameworks, with no standalone targets or agriculture-specific policies. Norges Bank Investment Management (NBIM) is the only investor that has agricultural methane included in its climate policy, while J.P.Morgan Asset Management and State Street Investment Management have methane policies focused only on the oil and gas sector. No investor analysed aligns their policies with the Global Methane Pledge, an international initiative aiming to reduce global methane emissions by at least 30% by 2030. In our scoring assessment of financial institutions’ methane-related policies, 80% scored less than 10% of the total available points.

Where investors do engage in methane it is limited to oil and gas companies. For example, J.P.Morgan Asset Management incorporates methane within sectoral carbon-intensity targets but focuses primarily on the oil and gas sector, while State Street conducted a targeted engagement campaign in 2022–2023 to assess methane management and encourage best-practice disclosure in oil and gas. NBIM is the only investor to explicitly reference the Global Methane Pledge, embedding methane expectations into its climate action plan and encouraging companies in methane-intensive sectors to set standalone methane targets.

In contrast, engagement with food companies focuses on deforestation, biodiversity or supply chain issues, with no expectations for methane disclosure, target-setting or mitigation. Investment in solutions, including alternative proteins, feed additives, low-methane livestock systems or methane-reducing rice practices, remains small and lacks any overarching strategy.

This disconnect creates significant risks for investors, including regulatory changes, transition costs, physical climate impacts and reputational exposure as scrutiny of food-system emissions intensifies. At the same time, it presents a clear opportunity for leadership in the transition to a low-methane food system. Emerging methane-reducing technologies, such as feed additives, alternative proteins and climate-smart agriculture, offer pathways to both risk mitigation and value creation.

Methane remains a systemic blind spot, but one that investors cannot afford to ignore.

Going forward: A call to action

To address this critical blind spot, investors must:

- Publicly recognise methane as a distinct climate driver, but also a major opportunity to slow global heating – a ‘climate emergency brake’.

- Integrate methane considerations into all net-zero strategies, especially in high-emitting sectors such as agriculture, energy and waste.

- Adopt dedicated methane policies, with expectations for disclosure, target-setting and mitigation across scopes 1–3.

- Set agriculture-specific methane reduction targets, aligned with science and covering the livestock value chain, that incentivise real-world methane reductions by portfolio companies.

- Align portfolio commitments with the Global Methane Pledge – to collectively cut global methane emissions by at least 30% by 2030 from 2020 levels.

- Shift capital toward sustainable proteins and resilient food systems, and away from high-emitting agriculture without a credible reduction plan.

You might also like...

Big Meat and Dairy’s Narratives To Derail Climate Action

Big Meat and Dairy companies are deploying ‘narratives’ in advertising, PR campaigns, and lobbying that paint the industry as greener than it really is and frame the stakes as too high to change. Like many p...

Seeing Stars: the new metric that could allow the meat and dairy industry to avoid climate action

Addressing methane emissions is essential to limiting the impacts of the climate crisis. However, the animal farming industry is promoting a new metric for measuring methane emissions, that could undermine t...

Big Emissions, Empty Promises

Big Emissions, Empty Promises, exposes weak national policies and corporate commitments that fall short of effectively reducing methane emissions and achieving meaningful climate action in agriculture. Read ...