Retailers turn blind eye to devastating impacts of farmed fish despite years of warnings, new report finds

- 76% of major European retailers failing to address the sustainability of their farmed fish supply chains, despite years of campaigns exposing the devastating impacts of global aquaculture industry

- No retailer has a clear target to phase out the hugely damaging practice of using wild-caught fish in feed

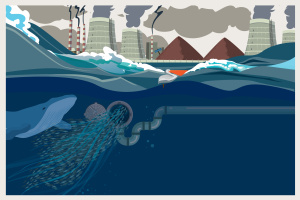

- Consumers are unwittingly contributing to the destruction of marine ecosystems and impacting food security and livelihoods of coastal fishing communities across Global South

A new report from the Changing Markets Foundation, Feedback and partner NGOs based in France, Germany, Spain and Switzerland has found that major supermarket retailers across the UK and Europe are turning a blind eye to the destructive and unsustainable nature of their farmed fish supply chains; appalling conditions for farmed fish; and misleading consumers over the true impact of consuming farmed seafood.

Published today, the Floundering Around report provides a stark account of how Europe’s 33 major food retailers (representing 49 national supermarket chains across the EU and UK including Sainsbury’s, Morrisons, LIDL and Asda) are failing to address key sustainability challenges in aquaculture. Despite being presented as a more environmentally friendly and sustainable form of protein, aquaculture in its current form is driving overfishing of the oceans, food insecurity in the Global South and poor fish welfare.

Retailers failing to address key sustainability concerns

Over three quarters of Europeans (77%) buy their fish from either a grocery store, supermarket or hypermarket. With their enormous financial heft and role as intermediaries between consumers and the fish farming industry, supermarkets are the most powerful players in the market and should drive forward transformative change in the aquaculture sector by demanding higher sustainability and fish welfare standards.

However, the report reveals that across six European countries, three quarters (76%) of supermarkets display a ‘near-total lack of substantive policies’ to address the lack of sustainability and transparency in their farmed fish supply chains. Crucially, no retailer has a clear target for the reduction and phased-out elimination of wild-caught fish in feed.

The FAO estimates that 34.2% of fish stocks globally are being overfished, up from 10% in 1974, while another 60% is fished to maximum sustainable levels (formerly known as ‘fully fished’). Despite being touted as a solution to overfishing, aquaculture is in fact contributing to the problem. Every year, almost 20% of the world’s marine fish catch is taken out of the ocean and converted to fish meal and fish oil (FMFO) to feed farmed animals (In 2018 this represented 18 million tonnes of global fish catch), with more than two-thirds of that amount destined for seafood farming. The vast majority of this is sourced from countries where food security is a problem, such as the West African region. A recent report found that, each year, over half a million tonnes of fish taken from West African waters are diverted to animal feed – enough to feed over 33 million people in the region. All three fish species used for FMFO production, critical to the food security in the region, have been assessed as overexploited, but the FMFO industry continues to drive their collapse.

The report shows only very few retailers are taking positive steps towards eliminating or reducing the use of wild caught fish in feed. French retailer Auchan has a target for transitioning 50% of the farmed seafood it sells to feed which contains less or no FMFO, while Tesco has a roadmap on how to accelerate the inclusion of alternative ingredients in feed. However, as a whole, the retail sector, is failing to grapple with this critical issue which has devastating impacts on marine biodiversity and communities in some of the poorest regions of the world.

“It is disappointing to see such a complete lack of leadership amongst European supermarkets when it comes to eliminating the use of wild-caught fish in aquaculture,” said Nusa Urbancic, Campaigns Director at the Changing Markets Foundation. “For years, we have documented the devastating impacts fishing for feed has on oceans and on food security of vulnerable communities in the Global South. Supermarkets pay lip service to sustainability in their public statements, but refuse to take meaningful action to eliminate this damaging practice from their supply chains.”

Alongside the lack of attention to supply chain sustainability, the report also found that while UK retailers have taken some steps to improve supply chain transparency in recent years, they are failing in their duty to inform customers of the origin of the farmed fish and seafood they sell and none of the retailers reports on the composition of feed used in their supply chains. 27% of European retailers do not include producer or farm name on fish labels, do not require public reporting by their suppliers on the composition and origin of feed used on their farms, and do not appear to have any reporting on fish welfare indicators in place.

Concerning blind spot on fish welfare

The growth of the global aquaculture industry over the past five decades has been exponential. From producing 5% of fish consumed globally forty years ago, the industry – worth an estimated US$263.6 billion globally– today provides half of the fish consumed globally; an estimated 100 million tonnes of fish per year.

The report also highlights significant shortcomings, when it comes to fish welfare. Half of retailers do not appear to require any reporting from their suppliers on fish mortalities and escapes, while very few retailers have safeguards in place to prevent high mortality rates on fish farms they source from. Only Waitrose has detailed procedures in place for suppliers to report on mortality and escape rates and said it would blacklist farms with high mortality rates if no improvement was forthcoming. While Tesco does not have an upper limit on mortalities, it told us that in critical situations it would stop sourcing.

The aquaculture industry is notorious for providing very little information on fish mortalities, but where data is available, the mortalities are concerningly high. Mortality rates on salmon farms in Norway stood at 15% in 2019, while Compassion in World Farming has estimated that average mortality rates on Scottish salmon farms were 24.2% between 2012 and 2017. This far outweighs mortalities found in other forms of intensive farming.

Nusa Urbancic said: “Industrial aquaculture causes untold suffering and yet most European retailers are failing to take steps to improve fish welfare in their supply chains. In the UK, salmon producers are planning to double production by 2030 which will almost certainly result in worsening conditions on farms. Retailers must push their suppliers to farm better or face serious reputational consequences.”

Jessica Sinclair Taylor, Head of Policy and Media at Feedback said: “Left unchecked, this unsustainable, unmonitored and unfair industry will cause irreversible environmental and societal impacts. We call on all the major European Food Retailers to recognise the vital role they can play in addressing the unsustainable nature of the aquaculture sector and demand a shift to more sustainable fish farming practices.”

Positive change required

The report is calling on retailers to recognise the role that they can play in lessening the devastating impact of the global aquaculture sector, by calling for:

- A commitment to phasing out the use of wild-caught fish in aquafeed and other farmed animal feed by 2025.

- The introduction of strict requirements on how farmed fish and seafood species are reared and slaughtered.

- The blacklisting of fish farms that have consistently high fish mortality rates.

- The introduction of greater transparency for consumers through improved labelling. This ties into customers’ right to know the origin of the farmed fish they buy, the origin and composition of what it was fed, and how it was reared.

Meanwhile the report calls on consumers to recognise the role that they can play, by:

- Demanding more of supermarket retailers and putting pressure on them to improve the transparency of their farmed fish (and wild-caught fish) supply chains.

- Limiting seafood consumption, especially farmed carnivorous species (such as salmon or prawns) that depend on the use of FMFO produced from wild fish.

ENDS.

Notes to editors

Media contacts

- Nusa Urbancic nusa.urbancic@changingmarkets.org

About the Changing Markets Foundation

The Changing Markets Foundation partners with NGOs on market-focused campaigns. Its mission is to expose irresponsible corporate practices and drive change towards a more sustainable economy.

www.changingmarkets.org / @ChangingMarkets

About the investigation

The Changing Markets report is entitled: Floundering Around: An assessment of where European retailers stand on the sourcing of farmed fish. It was published on 18th November 2021.

Link to report: http://changingmarkets.org/wp-content/uploads/2021/11/CM-WEB-REPORT-FINAL-FLOUNDERING-AROUND.pdf

This report offers an overview of the positions of Europe’s largest supermarket chains on the sustainable sourcing of farmed fish, which is a key issue for the global food retail sector.

It sets out to identify leaders and laggards according to their policies and practices in three priority areas:

- The phase-out of wild-caught fish in aquaculture feed

- Monitoring of mortalities on fish farms and blacklisting of producers with excessive mortality rates

- Transparency in aquaculture supply chains and product labelling.

The findings detailed in the report are based on a comparative review of six scorecards covering 33 major European food retailers which were published by the Changing Markets Foundation and partners between March 2020 and May 2021. Changing Markets has supplemented these with information gathered through correspondence with the same retailers between June and August 2021 in order to offer a comprehensive and up-to-date analysis of how the sector is positioned on this critical topic.

You might also like...

Erwischt: Wildfisch als Fischfutter für Aquakulturen!

This report outlines how effectively Austrian retailers are safeguarding the health of the oceans and fish welfare through the sustainability of their aquaculture supply chains. Read our German language report:

What Lies Beneath: Uncovering the truth about Peru’s colossal fishmeal and fish oil industry

This report calls for a rapid phase-out of the use of wild-caught fish to feed farmed fish and other farmed animals.

Fishing for Catastrophe

This report presents damning evidence that the production of fishmeal and fish oil for use in the growing global aquaculture industry is destroying fish stocks, marine ecosystems and traditional livelihoods.